Sustainability is a core element of corporate performance. A new Corporate Sustainability Reporting Directive (CSRD) [1] became effective on January 5, 2023, which requires new reporting rules on environmental, social, and governance issues. It replaces the European NFRD directive which introduced the obligation of extra-financial reporting. This reform is part of the EU’s new growth strategy: the European Green Deal, which seeks carbon neutrality by 2050.

The CSRD’s objective is to establish a standardized and common language for sustainability information to bring it to the same level as financial information. This directive increases the requirements for companies to be more transparent. It recognizes the concept of “dual materiality” which requires a company to report simultaneously on sustainability issues that are financially significant by affecting the company’s value, and material to the market, the environment, and people. This means that companies will have to disclose detailed and transparent information about how sustainability issues affect their own business (risks and opportunities – external perspective) but also inform about their impact on people and the environment (internal-external perspective).

I. Changes introduced by the CSRD

1° Reporting in accordance with the European green taxonomy framework

As of January 1, 2024, the CSRD will expand the scope of companies subject to sustainability reporting requirements. Eventually, about 50,000 companies will have to comply with these new rules – as opposed to about 11,700 with the NFRD.

The CSRD, along with other regulations such as the EU Taxonomy and the Sustainable Finance Disclosure Regulation (SFRD), are part of the European Green Deal: a set of regulations and guidelines that, according to the European Commission, “...will transform the EU into a modern, resource-efficient, and competitive economy...”. Companies wishing to comply with a set of minimum requirements will be required to report to the CSRD.

The new reporting must therefore properly include the data requested by the June 2020 European regulation on green taxonomy. This European framework requires activities to be classified according to six criteria: climate change mitigation, adaptation to climate change, sustainable use and protection of water and marine resources, transition to a circular economy, pollution prevention and reduction, and protection and restoration of biodiversity and ecosystems. Companies must therefore anticipate the taxonomy indicators - the key point of the new information, with an environmental component significantly more demanding than what was required by the Declaration of Extra-Financial Performance on areas such as climate but also biodiversity protection or circular economy.

The company will demonstrate that its business is:

- sustainable, if it substantially contributes to one of the six (above mentioned) environmental objectives without causing significant harm to one of the other five objectives and by respecting the basic social criteria defined by the Organisation for Economic Co-operation and Development (OECD) for multinationals and those of the United Nations relating to human rights;

- transitional, if it reduces the environmental impact in a sector for which there is no sustainable alternative –such as recycled aluminum production;

- enabling, if it allows other activities to contribute to one of the objectives. Examples include an activity that promotes active mobility or the protection and restoration of biodiversity and ecosystems.

2° Requirements for companies to disclose in the CSRD sustainability report

1/ According to the CSRD, the sustainability report is organized around three topics:

1. The environment: reporting should provide information on the company’s greenhouse gas emissions, including scopes 1, 2, and “if relevant” scope 3, but also on adaptation, impact on water and marine resources, resource use, circular economy, pollution, and impact on biodiversity and ecosystems.

2. Social: this includes promoting equal opportunities, improving working conditions and remuneration, and respecting human and fundamental rights.

3. Governance: this includes explanations of the role of governance bodies (ethics charter, anti-corruption policy), relations with external stakeholders (suppliers, management and quality of relations with business partners, political commitments such as lobbying), or the integration of the sustainability issue in decision-making, risk management, and the establishment of internal control bodies.

2/ Reporting covers 4 areas: 1. governance of sustainability issues; 2. company strategy and business model; 3. significant ESG impacts, risks and opportunities and their management; 4. targets and performance indicators.

3° The three information levels that companies must anticipate

The CSRD is more prescriptive than the NFRD regarding the approach to identifying key ESG impacts, risks, and opportunities on which to base sustainability reporting. It mandates the inclusion of much more detailed information in the annual management report of the companies concerned that should provide an understanding not only of the company’s impacts on sustainability issues but also of how these issues affect different parts of the company.

Companies will be requested to provide both retrospective and prospective analysis. This implies that they will have to share both quantitative information (such as the impact measured to date) and qualitative information (such as objectives, strategy, and risk assessment). Reporting companies may be required to disclose over 100 environmental, social and governance indicators. The 14 indicators of the EU Sustainable Finance Disclosure Regulation (EU SFDR Regulation of 10 March 2021) and the six objectives of the Green Taxonomy will constitute a basis for disclosure of the data required for the cross-sectoral –so-called “agnostic”– reporting level, i.e., the general level required for all companies, regardless of their business sector or size.

CSRD classifies three information levels:

1/ Common “agnostic” information for all sectors:

• They promote maximum comparability. A first set of 12 draft European Sustainability Reporting Standards (ESRS) (“Set 1”) has already been published by the European Financial Reporting Advisory Group (EFRAG) in 2022. They will be followed by final standards after their adoption by the European Commission in June 2023[2].

• This first set includes standards relating to environmental issues –concerning climate change, pollution, water and marine resources, biodiversity and ecosystems, and resource use and circular economy, specifically. EFRAG has proposed a number of ESG criteria. They encourage companies to further analyze not only their impacts but also the risks and opportunities related to sustainability issues. For example, biodiversity will also be addressed, including issues related to habitat, ecosystem restoration, ecosystem services, or biological diversity[3].

• In addition, aligning with international initiatives has been strengthened in Set 1 to promote as much “interoperability” as possible with international standard setting initiatives, and therefore avoid the need for international companies to provide multiple sustainability reports. EFRAG has worked –for example– with the International Sustainability Standards Board, the Global Reporting Initiative (GRI) and the Task Force on Climate-related Financial Disclosures (TCFD) to align concepts, content, and requirements.

2/ Sectoral information:

• The goal is to foster relevance at a specific industry level. Most sustainability topics can only be addressed in a meaningful way through a sectoral approach. Standards will be developed for ten relevant sectors by the end of 2023, with a targeted coverage of 40 sectors within three years

• The European sustainability reporting framework will be completed by June 30, 2024 with sectoral standards. Initially, it will cover ten sectors and the remaining 31 will be covered in the following two years. The sector standards will be mandatory for all large companies operating in a specific sector.

3/ Specific information:

• Companies will also disclose their own sustainability issues. If required, entity-specific information should be provided to cover all significant impacts, risks and opportunities identified.

• In addition, by June 30, 2024, the European sustainability reporting framework will be supplemented by specific standards for listed small and medium-sized enterprises (SMEs) and for non-European companies. Voluntary guidance for unlisted SMEs will also be provided. Standards for listed SMEs will be developed as well as guidelines for other SMEs that want to apply them voluntarily.

4° A « double materiality » assessment :

• “Double materiality” means factoring in both the external context’s impacts on the company and the company’s own impacts on the environment.

• All potential negative and positive impacts on people and the environment should be identified, if they are related to the company’s activities and its value chain.

• This implies that companies will have to publish detailed and transparent information on how sustainability issues:

1. impact their own business (risks and opportunities – external perspective).

2. impact people and the environment (internal-external perspective).

• The double materiality concept thus recognizes that a company must simultaneously account for sustainability issues that are: 1) financially significant in influencing the company’s value and; 2) significant to the market, the environment, and people.

• The sustainability report must therefore include:

1. The company’s environmental and social risks and impacts, such as loss of biodiversity or human rights violations within the value chain.

2. Sustainability risks and opportunities that may have a significant financial impact on the company, such as raw material shortages or extreme weather-related production disruptions or reputational risks.

The materiality approach has been clarified and simplified. The company will be expected to disclose all material information to cover all significant topics identified in the double materiality analysis.

5° All company areas will be concerned

CSRD will concern all company areas, as shown by these examples:

• In the risk and compliance area, companies will be expected to outline the main risks to the company related to sustainability issues and a depiction of how the company manages them, and to update risk management systems to include ESG obligations.

• The information must encompass the entire value chain: operations, products and services, business relationships and supply chains.

• In the context of investor relations, the company will need to prepare and manage investor inquiries and data requests regarding the reporting entity’s ESG credentials and investments made.

• Regarding governance and board-related issues, the company will be required to describe the role of the administrative, management and supervisory bodies in relation to sustainability and the expertise and skills they need to fulfill this role or their access to such expertise and skills. This will provide an understanding of: the relationship between sustainability and the entity’s business model and strategy, the company’s resilience to sustainability risks, and plans to ensure that the business and strategy are compatible with an economy in transition to limit global warming to 1.5°C.

II. Concerned companies and schedule

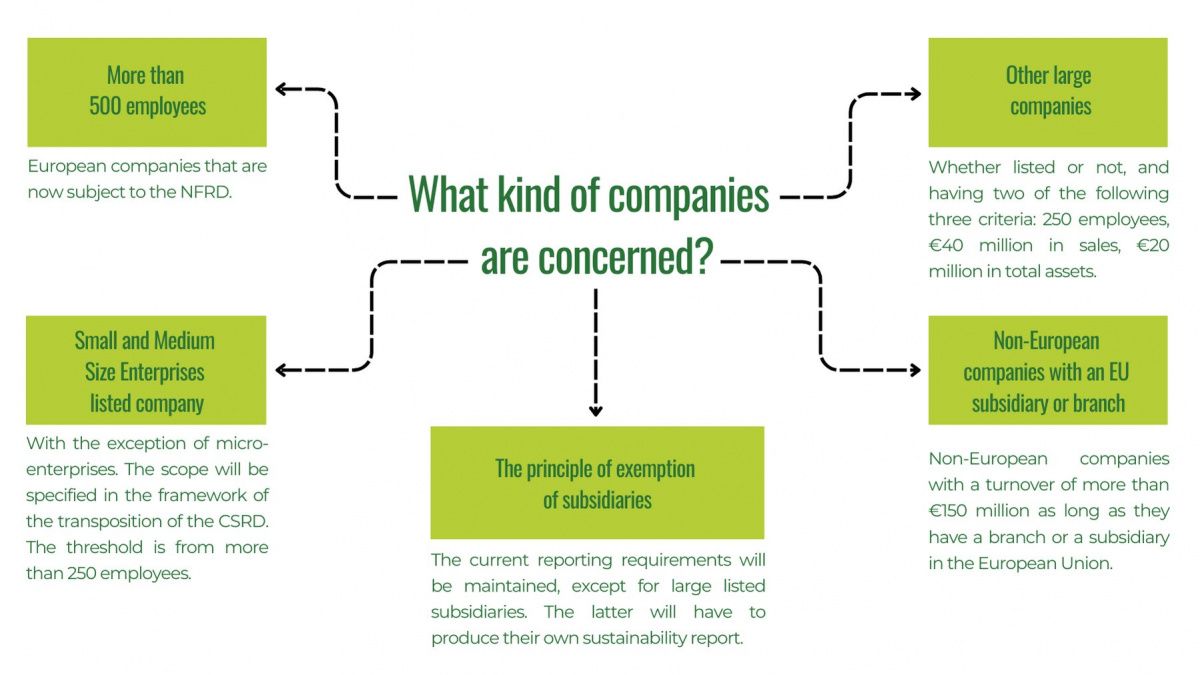

1° Within its scope, the CSRD defines 5 main business categories:

1. European companies that are currently subject to the NFRD: large companies with more than 500 employees.

2. Other large companies, whether listed or not, which exceed two of the following three criteria at the balance sheet date: 250 employees, €40 million turnover, €20 million in total assets. The parameters will be specified in the context of the CSRD transposition.

3. Small and medium-sized listed companies, except for micro-enterprises. The parameters will be specified in the context of the transposition of the CSRD.

4. Non-European companies with a €150 million turnover, as long as they have a branch or a subsidiary in the European Union.

5. The current exemption principle for subsidiaries will be maintained, except for large listed subsidiaries. The latter will have to produce their own sustainability report.

Accordingly, the CSRD’s application scope is much broader than that of the NFRD: the employee threshold is lowered to 250 employees, there is no longer any restriction on certain legal forms, notably simplified joint-stock companies and limited liability companies will now be concerned, and the CSRD introduces a form of extra-territoriality and will apply to non-EU companies with an activity within the Union.

2° Schedule :

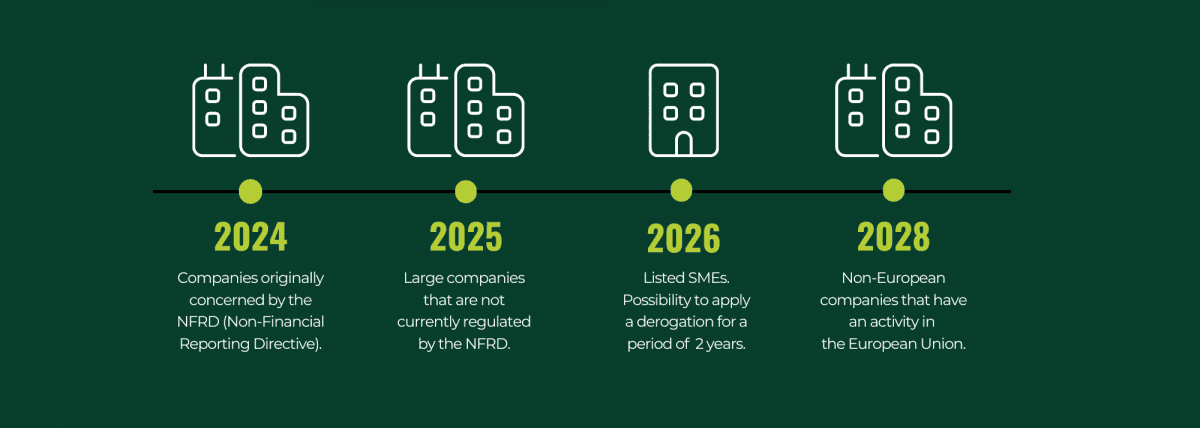

• The CSRD will apply from fiscal year 2024 (i.e., on 2024 data for a 2025 release) to companies that were covered by the NFRD.

• It will then progressively be extended between 2025 and 2028 to other eligible companies:

• Fiscal year 2025 for large companies that are not currently subject to the NFRD.

• Fiscal year 2026 for listed SMEs. Listed SMEs will be allowed to apply a derogation for a period of 2 years. This means that they can be exempted from the application of the directive until 2028

Fiscal year 2028 for non-European companies operating in the European Union.

III. CSRD and the projects’ impact: a critical issue for companies and Reforest’Action

To meet the companies’ requirements, Reforest’Action is aware of the need to be able to measure the long-term impacts of projects using robust tools and methodologies. On the one hand, this allows us to carry out actions in a sustainable and efficient way by setting up corrective actions if needed by the project. In the long term, this contributes to the regeneration of stable ecosystems, allowing us to respond effectively to climate and biodiversity issues. On the other hand, it contributes to the essential transformation of companies. By demonstrating to companies the impact of the projects they support, and in particular agroforestry projects in value chains, we can foster their adoption. This is crucial to comply with new regulatory frameworks and to promote a low-carbon and biocircular economy.

In 2021, Reforest’Action set up a Research and Innovation unit devoted to forecasting and measuring impacts. This developing project –the Forest Information System– aims to provide innovative solutions to develop and monitor (agro)forestry projects and their impacts on ecosystems over a 30-year period to support their stability. The tool will allow to perform impact projections based on robust methodologies, which will then be compared with the actual measurements obtained through the deployment of technological tools. It will provide companies with a complete analysis of the impact of their actions, according to their objectives.

The project is deemed operational on the carbon component, and is still being fine-tuned on the biodiversity, soil and social components, which are currently being developed and should be completed in the course of this year 2023.

IV- Fostering companies’ transition to a more sustainable model

The CSRD should encourage companies to move towards a more sustainable model. It will provide investors specifically, but also consumers, policy makers, civil society organizations and other stakeholders with all the financial and non-financial data they would need to assess the companies’ societal and environmental impact. Furthermore, it will help companies (SMEs) improve their attractiveness to investors and other stakeholders by improving disclosure requirements. Finally, it will provide investors with more accessible, in-depth and verifiable non-financial data that will allow them to make better informed (ESG) decisions.

The standardization of the sustainability report thus profoundly reexamines the companies' role and governance. They must therefore prepare themselves and comply with these new requirements. They can also make it a strategic lever for their operational performance and long-term sustainability. This is an essential prerequisite for the implementation of ambitious and transformative CSR policies.

Given this context, we at Reforest’Action believe that it is necessary to support companies to generate a positive impact with regeneration projects. On the other hand, we deem it our duty to accompany and support them by providing them with adapted and efficient solutions and in a continuous improvement process. The solutions we propose to companies allow them to act by impacting climate change, restoring biodiversity, preserving the quality of water and soil, or by bringing benefits to local communities.

References :

- Corporate sustainability reporting: https://ec.europa.eu/info/business-economy-euro/company-reporting-and-auditing/company-reporting/corporate-sustainability-reporting_en

- Directive (EU) 2022/2464 of 14 December 2022 (CSRD), published in the Official Journal of the European Union on December 16.

- First set of drafts ESRS (European sustainability reporting standards) – EFRAG technical advice, November 23, 2022.

[1] On November 28, 2022, the EU Council granted its final approval to the Corporate Sustainability Reporting Directive, based on the European Parliament’s position of November 16, 2022. It came into force on January 3, 2023. See: https://data.consilium.europa.eu/doc/document/PE-35-2022-INIT/fr/pdf. Corporate climate reporting was previously governed at the European level by Directive 2014/95/EU (amending Directive 2013/34/EU, the so-called “Accounting Directive”), requiring companies with more than 500 employees to include a non-financial statement in their annual report that includes a climate section, among others.

[2] Compliance with the ESRS will initially be subject to moderate assurance, but eventually reasonable assurance will be considered. For all practical purposes, companies will first need to determine whether they fall within the CSRD's scope and when they will initially be required to publish sustainability statements according to the ESRS. The challenges in applying the ESRS will vary according to whether a company is already subject to the requirements of the Non-Financial Reporting Directive (NFRD) and the member state in which it is located. The NFRD has left significant flexibility to member states for transposition into national law.

[3] EFRAG, [Draft] European Sustainability Reporting Standard E4 Biodiversity and Ecosystems, https://www.efrag.org/Assets/Download?assetUrl=%2Fsites%2Fwebpublishing%...

Photos Credits : Unsplash, Alesey Larionov.